“Peak oil demand” is the new “peak oil supply” thanks to plummeting costs for electric car batteries.

“Peak oil demand” is the new “peak oil supply” because of climate change and plummeting costs for electric car batteries.

It’s increasingly clear that we’re not going to move off of oil because we run out of supply. Rather, we’re going to move off of oil because it is both the economic and moral thing to do.

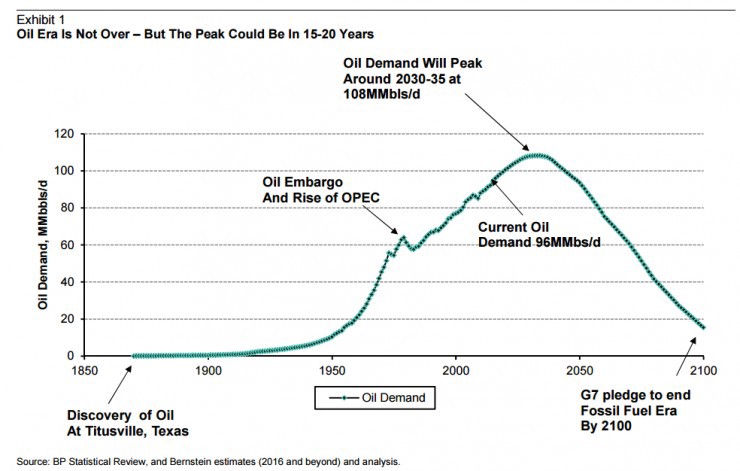

The research firm Bernstein notes that two “existential threats to the oil industry” exist — “climate change” and “advances in battery technology and computing power, which have resulted in a surge in interest in electric vehicles and autonomous driving.” They project the peak in oil demand could come as soon as 2030–2035:

This projection is quite similar to one from Bloomberg New Energy Finance (BNEF) that I wrote about earlier this year.

You know the oil industry is in long-term trouble when even the staid Financial Times editorializes, “Fossil fuel producers face a future of slow and steady decline” in a piece headlined, “The long twilight of the big oil companies.”

Significantly, the FT piece focuses exclusively on the implications of the “international objective of holding the increase in global temperatures to ‘well below’; 2C, agreed at the Paris climate talks.” This objective “implies the obsolescence of all fossil fuel production within the next few decades. The oil companies have not yet reconciled themselves to quite what this means.”

The Financial Times ends by bluntly laying out just what this means:

Instead of railing against climate policies, or paying them lip-service while quietly defying them with investment decisions, the oil companies will serve their investors and society better if they accept the limits they face, and embrace a future of long-term decline.

Existential threat #1 to oil, the ever-worsening reality of climate change, makes peak demand inevitable in the next few decades. Existential threat #2, the ever-improving reality of electric car batteries, will be one of the primary instruments of demand destruction.

Bernstein Research explains:

While their share of the overall transport market is small, EVs [electric vehicles] and PHEVs [plug-in hybrid electric vehicles] will gain market share over time and eventually have a material impact on demand growth. While we do not foresee this being material in the next five years, EVs will start to have an impact toward the middle of the next decade.

Similarly, BNEF has projected “electric vehicles could displace oil demand of 2 million barrels a day as early as 2023. That would create a glut of oil equivalent to what triggered the 2014 oil crisis.”

But that would require maintaining EV growth at the current very high rate of 60 percent a year, which BNEF considers “a very aggressive forecast.” BNEF models the costs of EV components and comes up with about half the current growth rate. In their scenario “we’ll cross the oil-crash benchmark of 2 million barrels a few years later — in 2028.”

Electric cars have always had a significantly lower per-mile fueling cost than gasoline-powered cars. This is true even with today’s oil low prices and even if you run the car on renewable electricity.

The key point is that sometime between now and 2025, batteries — which make about one-third the cost of an EV today — will come down in price enough that EVs will achieve cost-parity with internal combustion (IC) engine cars on the initial cost of the vehicle itself!

And this will be happening at exactly the same time that solar and wind power will be achieving penetration levels that allow electric utilities to offer very low rates for zero-carbon power — especially if the utility can be given some control over when most of the charging is done.

By the mid-2020s, then, EVs and new renewables in tandem will provide an alternative to IC vehicles that is superior in many respects — the same or lower first cost, a much lower annual fueling (and maintenance) bill, zero tail-pipe emissions of urban air pollutants, and zero total emissions of carbon dioxide. And this will all be happening during the decade when the increasingly painful reality of climate change makes governments even more desperate to slash CO2 emissions than they are today.

China Will Drive The Timing Of The Peak In Oil Demand

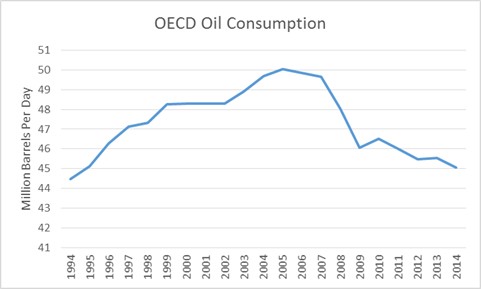

Oil demand already peaked over the last decade for the industrialized (OECD) countries:

Peaking in oil globally around 2030 would require the developing world’s recent rapid growth in oil use to slow over the next 15 years — and then ultimately reverse itself as the OECD has.

Since China has been the key driver of non-OECD oil demand growth, China will be the key driver in reversing global oil trends (just as it has been in reversing global coal trends). And just as China’s recent coal policy has been driven more by the urgent need to slash its intolerable urban air pollution than by its longer-term desire to preserve a livable climate, so too is China’s oil and transportation policy. After all, the dangerous air pollution in cities like Beijing is caused by both coal burning and dirty vehicles.

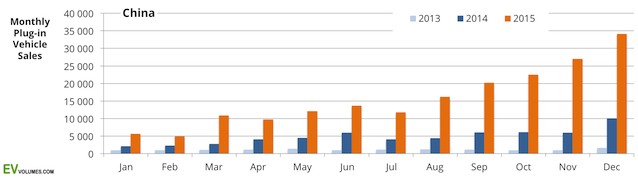

Unsurprisingly, then, China has made a huge bet on batteries and EVs. Also, China understands the future is low-carbon and then zero-carbon — so it intends to become the world leader in both the production and use of battery EVs, just as it already has in both wind and solar power.

The Chinese EV market tripled last year. China’s BYD Auto Company now appears to be both the biggest EV maker in China and the whole world. Here are China’s monthly EV sales for the past three years:

BYD projects China’s EV market will double in size this year, and again next year, and once again in 2018. That would mean China’s EV sales would blow past one million vehicles a year within three years.

“If China gets moving on electric cars then that would automatically lower prices and have a favorable ripple effect across the whole world,” as one auto expert has said. That is exactly what drove the exponential explosion in solar power worldwide this decade.

The bright dawn of renewables and electric cars means the long twilight of the big oil companies is in sight.

This post has been updated.