A Montana ballot initiative has incurred the wrath of Big Tobacco, which has spent a record-breaking amount of money to defeat it this November. Should it succeed, 100,000 people could lose health coverage.

The tobacco industry raised nearly $17.5 million to defeat I-185, a measure that gives health care to people earning up to 138 percent of the poverty level by taxing tobacco. Montana expanded Medicaid under the Affordable Care Act (ACA) in 2016, but only until July 2019. To avoid sunsetting the policy and, thus, taking away coverage from nearly 100,000 people, Montana residents need to vote yes to I-185. But by voting yes, voters are also agreeing to increase a tax on a pack of cigarettes from $2 to $3.70 and 33 percent for tobacco products like e-cigarettes.

To ensure this doesn’t happen, the maker of Marlboro cigarettes (Altria Client Services) and the parent company of RJ Reynolds’ Camel cigarettes (RAI Services Company) have donated millions to the Montanans Against Tax Hikes, a political committee opposed to I-185. In total, the group has raised $18.5 million as of its latest filing from October — the most money raised against any ballot initiative in the state’s history. The last record set was $4.3 million with I-147, a measure that tried to reverse the state’s ban on cyanide leach mining in 2004.

Montanans Against Tax Hikes have even raised more than Sen. Jon Tester (D-MT), who’s trying to fend off an especially competitive Republican challenger and raised $17.9 million as of its latest filing from September.

For comparison, the political committee that supports Medicaid expansion, Healthy Montana, raised roughly $9.2 million. Health advocacy groups, most notably the Montana Hospital Association, are largely behind I-185. The Fairness Project, a non-profit spearheading ballot questions across the country, also donated nearly $405,000 to Healthy Montana. The Fairness Project helped Mainers expand Medicaid by ballot last November, but an obstructionist governor has blocked it from happening. Now, Big Tobacco companies threaten to stop another Medicaid expansion by ballot.

“This is like arsonists trying to defund the fire department. Big tobacco companies lied to sell their products and make people sick, and now they’re lying to avoid paying their fair share,” said The Fairness Project Executive Director Jonathan Schleifer in a statement to ThinkProgress.

“Voters in Montana have a simple choice: side with companies that kill or with Montanans who need access to healthcare.”

Montana needs to tax tobacco products because beginning in 2020, states participating in Medicaid expansion will have to pay 10 percent of costs associated with the program. The federal government used to pay the full cost of the program until 2016. But while states’ shares are going up, multiple studies suggest states ultimately save by offsetting costs elsewhere.

Montana, for one, was able to save block grant, alcohol tax, and general fund dollars with Medicaid expansion because Medicaid paid for people’s addiction treatment instead, according to a recent study. And the state was also able to redeploy $1.5 million to other critical services because insurance covered basic treatment.

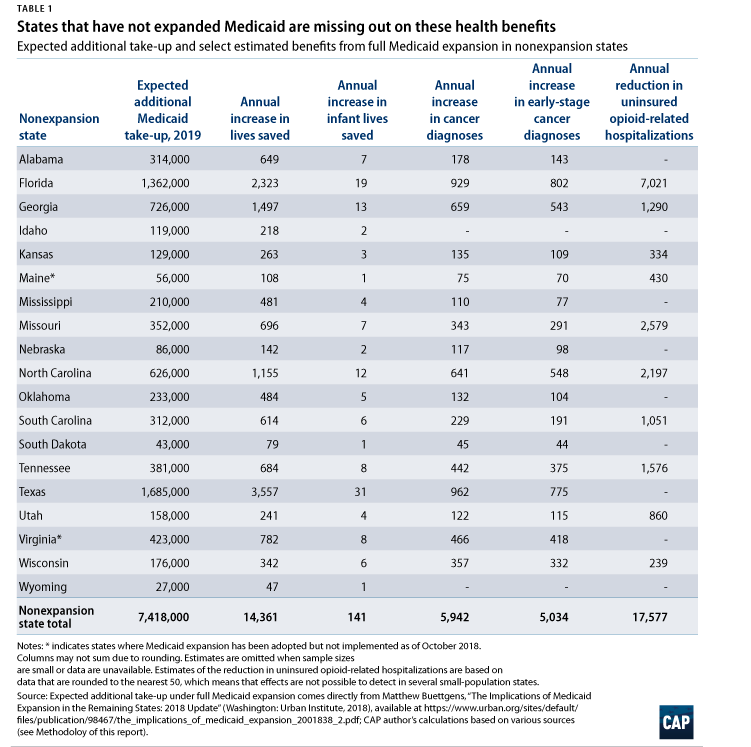

Seventeen states have not expanded Medicaid, but there’s a chance that will change as it’s on the ballot this November in Montana and three other states: Idaho, Nebraska, and Utah. Should residents in these three states vote to expand Medicaid, 6,000 lives could be saved over 10 years, according to a Center for American Progress study. (ThinkProgress is a editorially independent news organization housed in the Center for American Progress.)

CORRECTION: This piece mistakenly labeled Sen. Tester as a Republican. It has been updated to reflect that he is a Democrat.