A proposed merger between two major energy companies could have offered the promise of accelerated renewable energy growth in the Southeast. Instead, the deal between Dominion Energy and South Carolina-based SCANA Corp. is expected to prioritize expensive fossil fuel projects, a move that could have long-term implications for millions of utility customers.

South Carolina electricity customers and lawmakers are still reeling from the demise of a major nuclear power expansion project in the state. The project’s failure means SCANA subsidiary South Carolina Electric & Gas (SCE&G) — and Dominion, if the merger succeeds — will need to find alternatives to the 2,200 megawatts of electric generating capacity that will not be coming online.

Nowhere in their Wednesday merger announcement did Dominion officials mention a commitment to building new renewable energy projects to replace the electricity from the failed V.C. Summer nuclear project. Energy efficiency also wasn’t proposed as a way to help avoid the construction of new fossil-fueled power plants.

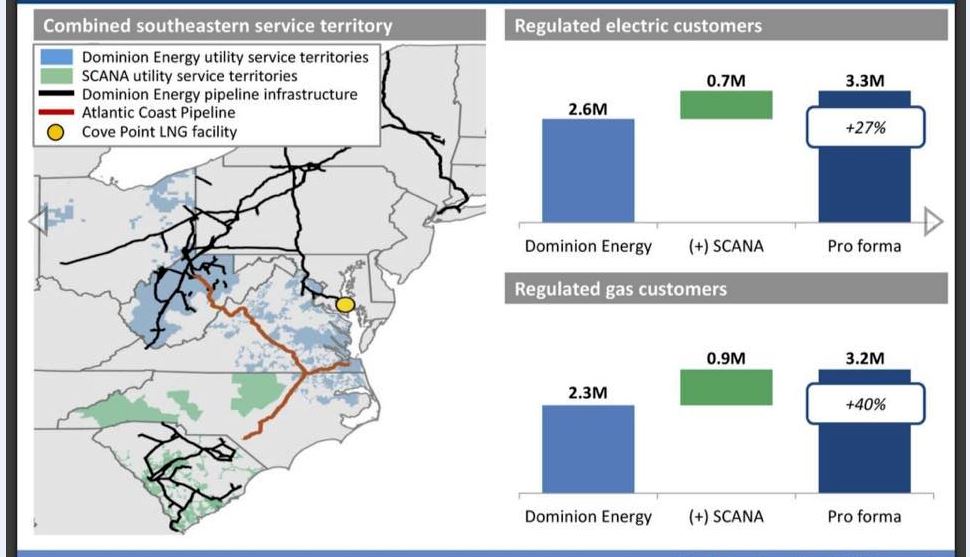

Dominion, a Richmond, Virginia-based company, announced it would issue refunds totaling $1.3 billion — a portion of the $9 billion spent on the canceled project — to customers in South Carolina. If the merger deal is completed, Dominion also promised cash refunds of about $1,000 per household to SCE&G’s 662,000 customers. The acquisition of SCANA would make Dominion a utility with a total of 6.5 million customers in eight states.

Environmental groups cautioned that Dominion’s acquisition of SCANA would still force South Carolina customers to pay an enormous portion of the costs for a nuclear plant that will never produce power. The deal also will likely serve as a springboard for extending Dominion’s controversial Atlantic Coast Pipeline (ACP) into South Carolina. Opposition to the proposed pipeline has intensified in Virginia and North Carolina over the past couple of years due to its projected impact on the environment and its role in increasing greenhouse gas emissions.

“Dominion’s actions in Virginia and North Carolina should set off alarms for South Carolina leaders,” SELC attorney Gudrun Thompson said in a statement. “Dominion is planning to bore holes through mountains, and dig risky tunnels under lakes, streams, and reservoirs to make more pipeline profits. Dominion is in the business of serving itself first and customers second, and South Carolina should pay attention to that.”

Dominion is arguably the most powerful company in Virginia, with state lawmakers routinely giving green lights to the company’s shareholder-friendly legislative and regulatory proposals. Like SCANA’s proposal to build two new nuclear reactors in South Carolina, Dominion is known for pushing capital-intensive projects that boost its bottom line, such as the Cove Point LNG project and ACP, but are not crucial for maintaining a reliable energy system.

Regulated utility companies tend to favor solutions that require large expenditures of capital rather than an increasingly diverse array of alternatives such as energy efficiency and demand-reduction options that could meet customer needs, often at lower cost.

“Profits are dependent on new capital investments,” Eddy Moore, energy and climate program director for the S.C. Coastal Conservation League, told ThinkProgress. “If you go to Wall Street and say, ‘We don’t think there’s going to be demand growth, so we’re not going to need anything new,’ it’s not going to be good for your stock prices.”

Along with power plants, natural gas pipelines can bring significant returns to companies. Interstate pipelines are currently getting about a 14 percent return on equity from federal regulators, a rate that provides a strong profit motive for companies to pursue the construction of pipelines. Observers partially attribute Dominion’s decision to build ACP to the company’s pursuit of higher returns for its shareholders.

If completed, ACP will deliver fracked gas from West Virginia, Pennsylvania, and Ohio to markets in Virginia, North Carolina, and beyond. The pipeline would travel through environmentally sensitive areas — and could be extended into South Carolina to connect with SCANA’s natural gas system.

“With substantial cutbacks in the need for gas-fired generation in Virginia and North Carolina, the ACP needs to find a market for the gas carried by the pipeline somewhere. South Carolina is such a market. The output from the abandoned nuclear plant will have to be replaced by energy efficiency, renewables, or new gas-fired generation, or a combination of these,” Thomas Hadwin, a former executive with electric and gas utilities in Michigan and New York, said in a statement emailed to ThinkProgress. “If South Carolina is like most other states, the demand is not growing to the degree expected by those who proposed the nuclear plant.”

Hadwin said utility customers in Virginia and North Carolina will pay “billions more” based on Dominion’s decision to build ACP rather than use existing pipelines or rely on existing renewable and energy efficiency alternatives.

Natural gas producers also could see benefits from the merger as they likely would gain access to new markets through ACP, which could deliver natural gas produced in the Marcellus Shale and Utica Shale to power plants in South Carolina and potentially connect with a pipeline that would send natural gas to the Elba Island liquefied natural gas facility in Georgia, a terminal that will soon be able to export natural gas.

South Carolina lawmakers are lamenting their decision to essentially give SCE&G a blank check to co-develop two new nuclear reactors with fellow South Carolina utility Santee Cooper. In 2007, they voted for a much-maligned law called the Base Load Review Act, which enabled utilities to charge customers up front while the nuclear reactors at the Summer plant were being built. The law made it easier for SCE&G to raise the rates of its customers and then leave the same customers holding the bag for $9 billion in money spent on the failed Summer nuclear project.

Dominion is hoping it receives similarly favorable treatment from South Carolina lawmakers and regulators. The company delivered a veiled warning to lawmakers who are tasked with deciding who will pay for the failed nuclear plant project. Dominion chief executive Thomas Farrell said his company could walk away from the deal if lawmakers took any actions that cause “adverse economic consequences,” a likely reference to any attempt to repeal the Base Load Review Act.

“The take-it-or-leave-it deal falls far short of protecting ratepayers from absorbing the costs of the nuclear fiasco, while replacing the unneeded nuclear plant with unnecessary natural gas capacity instead of cheaper and cleaner energy alternatives,” environmental group Friends of the Earth said Wednesday in a statement.