The rallying cry of Republicans during tax bill negotiations was that this legislation was created with the middle class in mind.

It’s a lie the Trump administration told the American people time and time again — over 84 times.

In reality, the GOP tax bill will do very little for lower and middle income families. Study after study of the tax plan shows the plan will ultimately benefit the wealthiest Americans. The non-partisan Tax Policy Center found that after the tax plan has taken full effect in 2027, 80 percent of the benefits would go to the top 1 percent. When it comes to tax cuts, the top 1 percent will get an average cut of $1,022,120, while the middle 20 percent will get an average cut of $420, eviscerating any notion that the middle class are the key beneficiaries of the Republican’s “Unified Framework for Fixing Our Broken Tax Code.”

Those who will benefit the most from the tax bill, however, are the same the ones who helped construct it.

A new report from the Center For American Progress Action Fund (ThinkProgress is an editorially independent news site housed at CAPAF) looked at the personal financial disclosure forms of the members in each chamber’s tax writing committee and identified all income from “pass-through” businesses — income that would be taxed at a significantly lower rate under the new tax law.

15 Republicans from tax writing committees in Congress will expect to receive an average tax windfall of $314,000 from the legislation they helped craft.

This includes members of the House Ways and Means Committee like Reps. Carlos Curbelo (R-FL), Diane Black (R-TN), Jim Renacci (R-OH), and Vern Buchanan (R-FL) among others, and members of the Senate Finance Committee like Sens. Rob Portman (R-OH), Chuck Grassley (R-IA), and Dean Heller (R-NV).

There are 53 Republican members of Congress not from tax writing committees who will benefit from various provisions in the GOP tax plan. These members of Congress could see an average tax cut of $280,000 dollars.

Speaker of the House Paul Ryan, who announced his retirement Wednesday morning, cited the passage of the tax bill as one of his greatest accomplishments during his time in Congress. He can expect to receive a tax cut of about $11,500 under the pass-through loophole.

Ryan's getting a big tax cut for three main reasons: (1) He is a passive investor in several "passthrough" businesses, which produced $116,000 of income in 2011. The tax bill creates a new deduction for such investors. (I assumed he gets the full benefit of that deduction.) 3/ pic.twitter.com/jv300fYcT9

— Seth Hanlon (@SethHanlon) February 3, 2018

Under the guise of helping “small businesses” a tax loophole was created in the House Ways and Means Committee for individuals who own “pass-through” entities like partnerships, S-corporations, and limited liability companies (LLCs). The provision would have slashed the tax rate for top-bracket owners of pass-through entities from 39.6 percent to a maximum of 25 percent. The final bill attempted to fix this, but not by much. The final transformed the pass-through tax break into a deduction against taxable income, effectively cutting the top rate on pass-through income to 29.6 percent.

Hidden in the 503-page final legislative text, however, was a new provision that had not been included in previous House or Senate versions. It specifically benefits real estate investors who operate “pass-through” businesses. This group includes people like Sen. Bob Corker (R-TN), who “has millions of dollars of ownership stakes in real-estate related LLCs that could also benefit” from the new provision.

And even though deficit-hawk Sen. Corker would like the country to believe that this bill could be “one of the worst votes [he’s] ever cast,” according to the data, Corker could see potential tax cut of $706,383.

President Donald Trump, himself an owner of a pass-through real estate empire, signed the legislation into law on December 22.

Around 86 percent of actual small businesses — mom-and-pop Main Street Businesses — already pay a tax rate lower than 25 percent. This is because, under the current tax code, profits are taxed according to the owner’s individual tax rate, which, for the majority of small business owners, is lower than 25 percent. Regular employees are not eligible for the pass-through deduction, and while some small business owners can potentially claim it, they’re required to navigate a thicket of confusing new rules.

But wealthy investors in pass-through entities, including the 15 members of Congress who helped create this beast, stand to benefit the most.

This isn’t the only provision in the tax bill that Republicans and the Trump administration attempted to sell as a boon to middle class Americans. After the corporate tax rate was slashed from 35 to 21 percent, corporations began to hand out “tax bill bonuses” to their workers. Corporations have been flush with cash for a while now, with Trump himself repeatedly tweeting about how well the stock market is doing. These entities could have doled out bonuses at any time, but chose to wait until the Republicans passed the most sweeping change to the United States tax code in decades as a publicity stunt to make both their companies and the businessman-turned-politician President Trump look better.

Some corporations, like Walmart and Comcast, began to lay off thousands of workers after they announced bonuses for their workers. Others have announced outright their intentions to spend their tax savings on buybacks for shareholders.

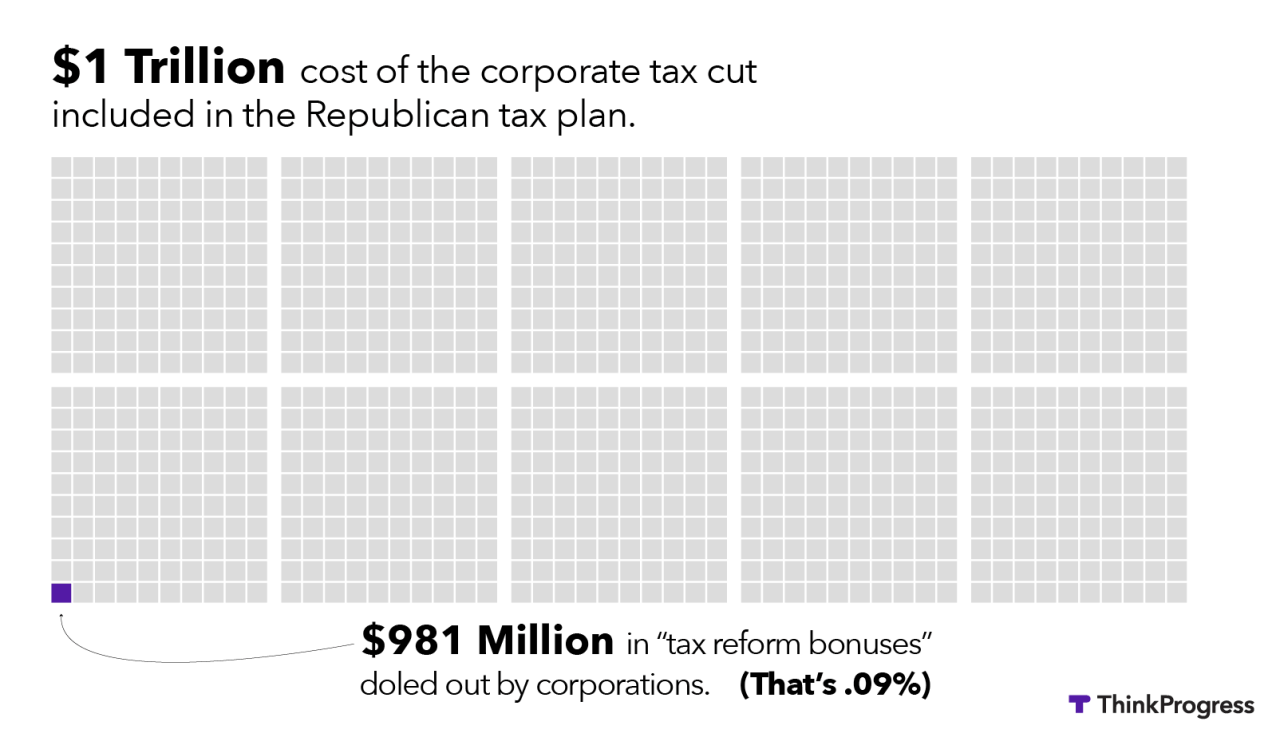

The GOP tax bill will cost a total of $1.4 trillion dollars, with the corporate tax cut alone costing a massive one trillion dollars. A ThinkProgress analysis of the Americans for Tax Reform report found that the bonuses total roughly $981 million, only .09 percent of the total cost of the corporate tax cut.

Only two percent of Americans have said they’ve noticed a bonus due to the tax bill.