JPMorgan Chase is the latest big bank to make headlines for raising wages as a result of the recent corporate tax cut.

22,000 lower-paid, full- and part-time JPMorgan employees will see their wages increase from $12 and $16.50 an hour to $15 and $18 an hour, in addition to a $750 bonus. The bank also plans to open up 400 new branches over the next five years.

It all sounds fantastic.

But beyond the flashy headlines, America’s largest bank isn’t really doing much for its workers.

These wage increases are a drop in a bucket compared to the total amount of money JPMorgan will receive as a tax windfall from the GOP tax bill. According to a Goldman Sachs report obtained by ThinkProgress, the bank is expected to save $3.3 billion dollars. Jamie Dimon, the bank’s CEO, is even more optimistic, estimating JPMorgan would save $3.6 billion this year. JPMorgan’s pay hikes amount to an average of 10 percent for these 22,000 employees. By taking the current average median pay for bank employees and raising it 10 percent, JPMorgan Chase will be spend roughly 1.8 percent of the annual value of their tax cut on their employees.

Meanwhile, the bonuses JPMorgan is touting are identical to those paid for the last few years, a spokeswoman for the bank told CNN. Wells Fargo similarly announced shortly after the passage of the tax bill that they would be raising wages as well, but a spokesperson for the bank later clarified the wage increases were planned and not linked to the tax bill.

This is similar to the amount of money other corporations getting big tax breaks will be spending on their employees in the form of higher wages. Walmart is providing a one-time bonus of up to $1000 — employees need to have worked at the company for 20 years to qualify for the full amount. Those payments amount to just over 2 percent of the total value of the tax cut to the company. With the new 21 percent corporate tax rate, the tax cut is worth at least $1.85 billion to Walmart every year. Since the tax cut is permanent, the true benefits to Walmart will only grow larger with time. Over 10 years, it will certainly be worth over $18 billion.

And while JPMorgan is planning on opening new branches, it also plans on closing them too, primarily in more rural areas. The bank notably declined to answer whether their total number of branches would decrease.

This is similar to how other corporations are handling their tax bill wages and bonuses: in the headlines they boast their dedication to their employers while in the background, many are losing their jobs due to branch closures or layoffs.

Comcast, which announced $1,000 bonuses to their employees when the GOP tax bill was passed, laid off more than 500 sales employees right before Christmas. AT&T also announced their tax bill bonuses, while the telecom giant was in the process of laying off thousands of employees, according to the Communication Workers of America (CWA) union, which represents AT&T workers. The union filed a lawsuit against the company claiming that some of those layoffs are needless, and that the timing of the terminations — just two weeks before Christmas — represents “an extraordinary act of corporate cruelty.”

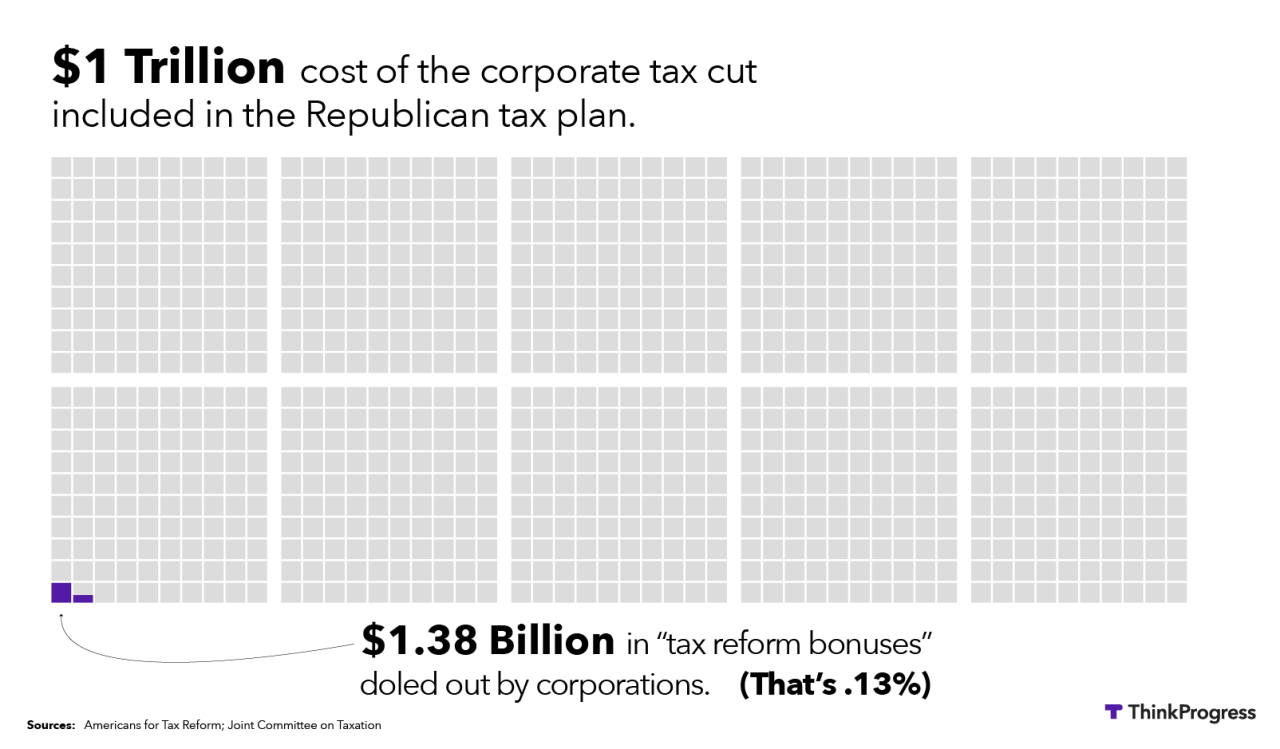

More broadly, according to a list compiled by Americans for Tax Reform, roughly 55 companies have announced one-time bonuses following the passage of the tax bill. After Walmart’s announcement, the bonuses now amount to 0.13 percent of the value of the tax cuts to corporate America.